Which of the Following Statements Regarding Investment Risk Is Correct

A There is very little risk in an IPO since returns often exceed 20 in the first day. Beta is a measure of systematic non-diversifable risk.

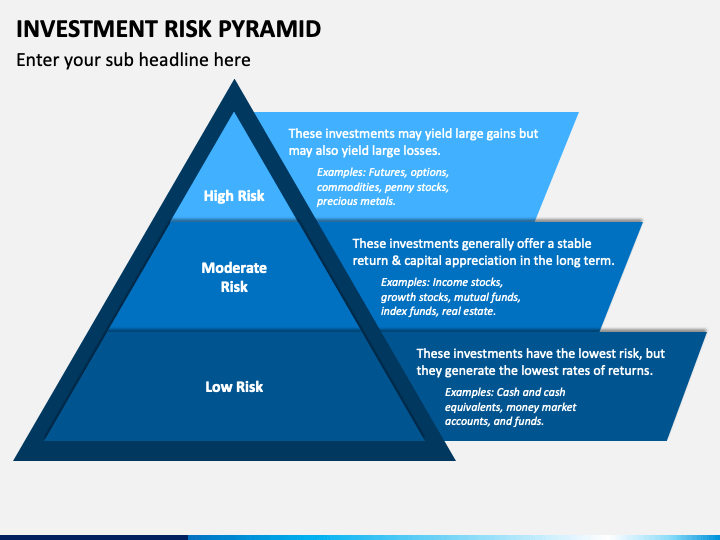

Investment Risk Pyramid Powerpoint Template Ppt Slides Sketchbubble

Which of the following statements regarding returns from 1920-2004 is true.

. Junk bonds are low risk low yield bonds. The stated maturity is generally 10 years. The acceptable level of financial risk for a firm depends on its business risk.

Which of the following statements regarding investment risk is correct. A debenture bond is secured by a mortgage. Financial risk and business risk are both important but they are not related in any way.

All mortgage bonds are subject to an indenture agreement. Asset A has an expected return of 6 and a volatility or standard deviation of 12. Rational investors will form portfolios and eliminate sys 3.

You Answered For some stock investments a longer-term investment may be considered safer than short-term. Realized Returns and Risks from Investing 27. A specified benefit is promised to be paid at retirement.

The return on a riskier investment will always exceed the return on a less risky investment so as to compensate the investor for the higher risk incurred b. B Flight to quality is usually reflected in a decrease in the yield spread between corporate and government issues. Idiosyncratic risk is the main determinant in the valuation of securities.

Common stocks had annual average returns almost double that of bonds. Which of the following statements regarding an investments time horizon and its risk is correct. After considering purchasing power bonds outperformed stocks during this.

Which of the following statements is true with regard to the risk of investments. Risk management is unique to the health care industry. D Trying to avoid risk is an exercise in futility.

An auditor will perform various risk assessment procedures to ensure that appropriate attention is paid to the accounts and transactions least at risk of being materially. A firm with a greater degree of financial risk typically takes on less business risk. Which of the following statements regarding default risk is CORRECT.

All of the following statements regarding capital market theory are correct EXCEPT. Which of the following statements regarding risk in investing is most correct. 1 Beta is a measure of systematic non-diversifiable risk 2 Rational investors will form portfolios and eliminate.

The capital asset pricing model CAPM relates the required rate of return for any. Risk management is concerned with reducing exposure to legal liability. All of the following statements regarding characteristics of defined benefit plans are TRUE EXCEPT.

Risk management is controlled and managed by HIPAA regulations. The risk of a stock associated with factors specific to the firm is called the systematic risk. Which of the following statements regarding investment risk is correct.

Systematic risk is the relevant risk for a well-diversifed portfolio. Which of the following statements is true regarding an investment in mortgage-backed securities. Rational investors will form portfolios and eliminate systematic risk.

Systematic risk can be diversified. Because stocks tend to offer attractive risk-adjusted returns over the short run investors with a short investment horizon are traditionally advised to allocate a large. The benefits are usually expressed as a.

Which of the following statements regarding investment risk are CORRECT. When they retire some investors get completely out of the stock market. Asset B has an expected return of 8 and a volatility or standard deviation of 20.

Which of the following statements about risk management is true. 2 The employer bears the investment risk under the plan. Investors have little interest in bond ratings.

3 If an employer maintains a SEP plan and a qualified plan. The inherent risk assigned in the audit risk model is unaffected by the auditors experience with clients organization. Graded quiz on the content of Week 2.

A firm with a greater degree of business risk has the ability to take on more debt. Default risk is unrelated to the financial strength of the issuer. A basic function of accounting information is to assist investors in predicting risk and return cobtaining resources from creditors is generally less risky for an organization than is.

Up to 25 cash back Points. They receive a fixed payment per month. Which of the following statements regarding investment risk is correct.

A portfolio containing a large number of assets contains relatively higher systematic risk. Which of the following statements regarding risk assessment is correct. Most auditors set a low inherent risk in the first year of an audit and increase it if experience shows that it was incorrect.

Which of the following statements regarding inherent risk is correct. 1 Employees cannot rely on a SEP plan alone to provide an adequate retirement benefit which may hinder appreciation of the plan by employees. Which of the following statements regarding the impact of age on the investment profile are true.

Which of the following statements regarding the risk of an asset is correct. B It is most important to avoid risk during the early years up to age 54. Beta is a measure of systematic non-diversifiable risk.

An investment with a longer time horizon will generally require a higher return. C It is hard to achieve a positive real return by avoiding risk all together. Bonds averaged returns during this period below the inflation rate.

Rising inflation represents purchasing power risk. There is little default risk. B Mutual funds containing mostly large stocks are more risky than mutual funds containing smaller stocks.

Rational investors will form portfolios and eliminate unsystematic risk. Which of the following statements regarding the disadvantages to the employer of SEP plans isare CORRECT. The employer assumes the investment risk.

Information risk is the risk that an auditor expresses an inappropriate audit opinion when the financial statements are materially misstated. The correlation between assets. Rational investors will form portfolios and eliminate unsystematic risk 4.

Financial risk is more important for. Systematic risk is the relevant risk for a well-diversified portfolio. C Yield spread between on-the-run and off-the-run securities mainly captures the liquidity premium and not the market and credit risk premium.

A Asset liquidity risk arises when a financial institution cannot meet payment obligations. A firms decision to buy back some of its own stock in the open market by borrowing funds through a new bond issue is an example of reinvestment rate risk. The capital asset pricing model CAPM allows an analyst to measure the relevant risk of an individual security as well as to assess the relationship between the risk and returns expected from investing.

They are not subject to prepayment. Risk management is a spontaneous response to an unexpected incident. A Avoiding risk is the best strategy to accumulate wealth.

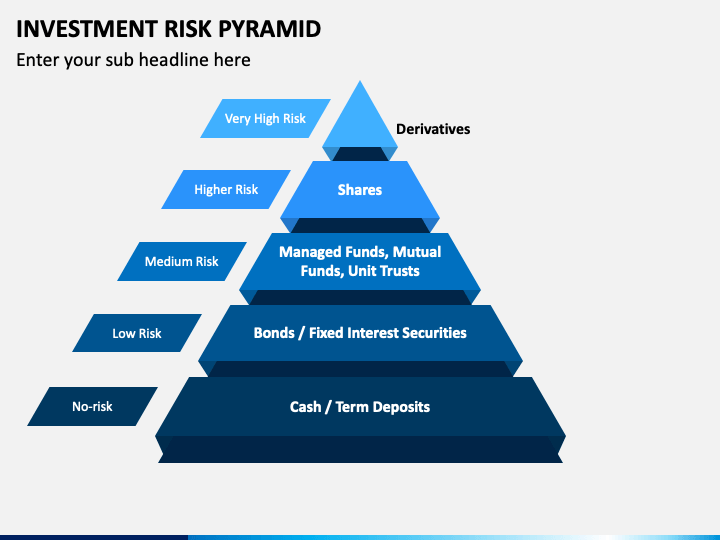

Investment Risk Pyramid Powerpoint Template Ppt Slides Sketchbubble

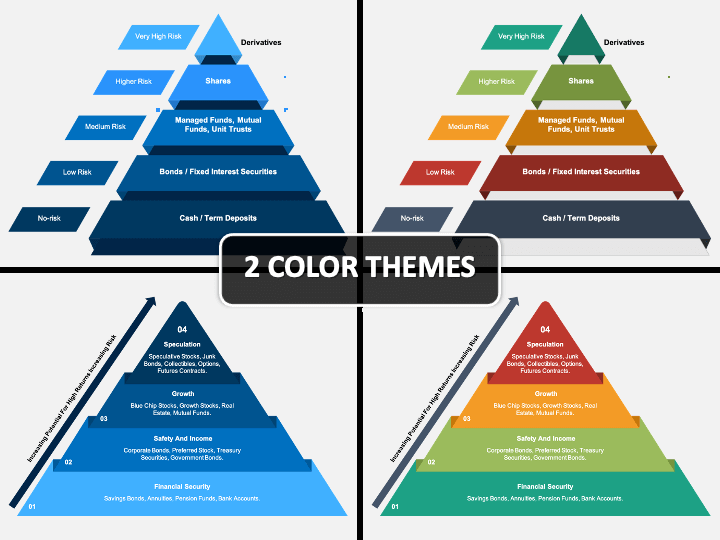

Investment Risk Pyramid Powerpoint Template Ppt Slides Sketchbubble

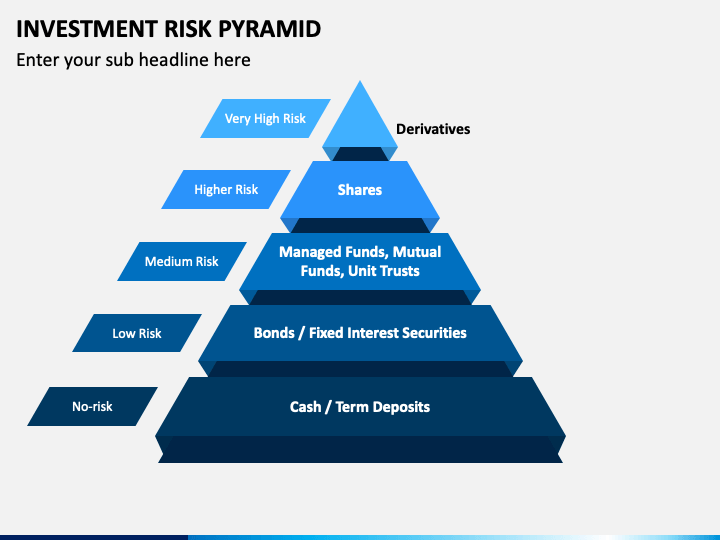

:max_bytes(150000):strip_icc()/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

Comments

Post a Comment