Describe the Relationship Between Detection Risk and Audit Risk

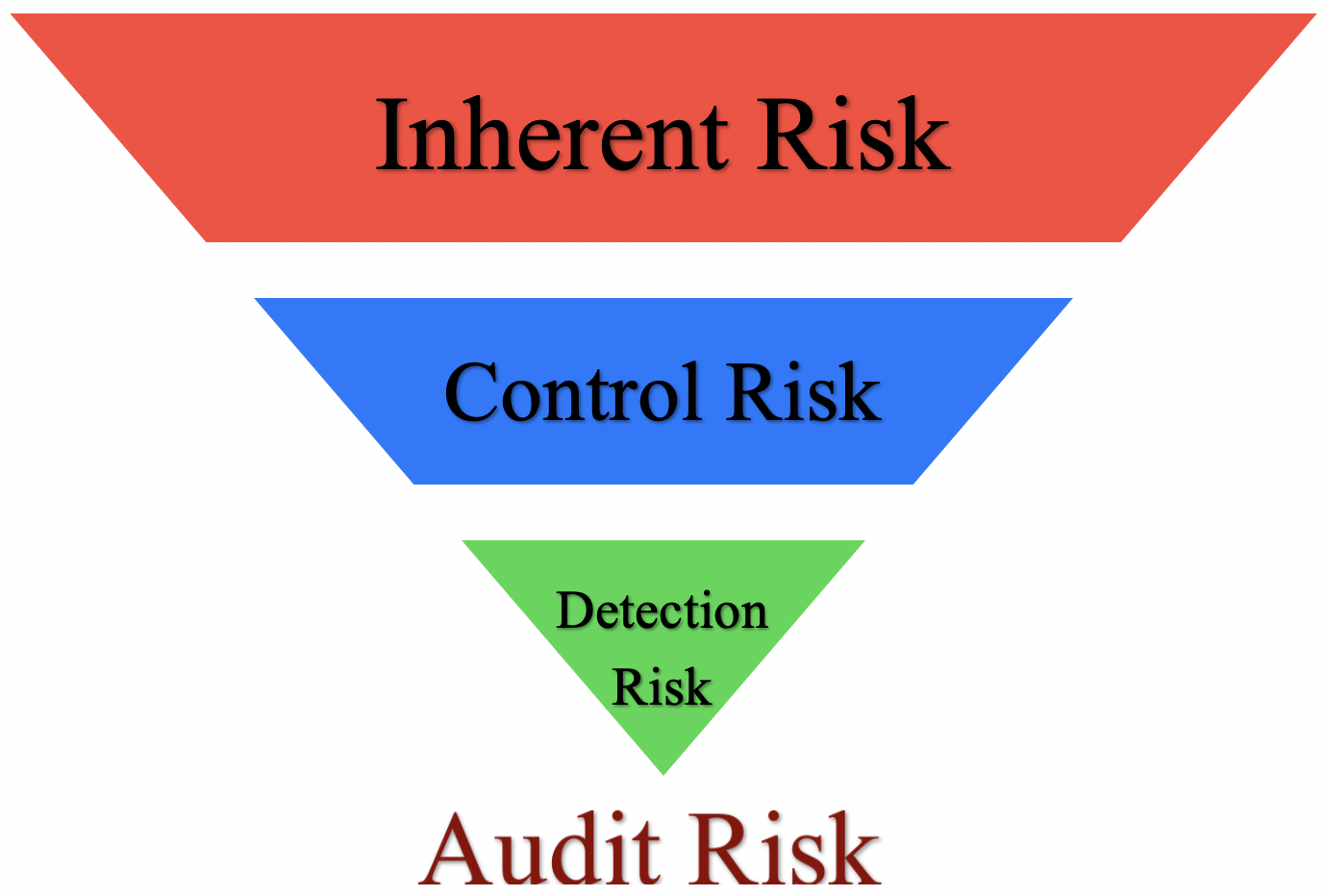

Inherent and control risk are the risks of material misstatement arising in the financial statements. The inherent risk control risk and overall audit risk.

3 Types Of Audit Risk Inherent Control And Detection Accountinguide

Detection risk forms the residual risk after taking into consideration the inherent and control risks of the audit engagement and the.

. If the client shows a high detection risk the auditor will likely be able to detect any material errors. A certain amount of detection risk will always exist but the auditors goal is to lower the detection risk sufficiently for overall audit risk to maintain an acceptable level. It is composed of the possibility that 1 a material misstatement in an assertion about an account has occurred inherent risk and control risk.

Describe the relationship between detection risk and audit risk. Where the auditors assessment of inherent and control risk is high the detection risk is set at a lower level to keep the audit risk at an acceptable level. These elements of the audit risk model are noted below.

Here is the formula. Control risk is caused by the failure of existing controls or the absence of controls leading to incorrect financial statements. In risk based audit engagements understanding different kinds of risk become extremely important.

Detection risk is the possibility that an auditor will not locate a material misstatement in a clients financial statements via audit procedures. This problem has been solved. Audit risk is the risk that the.

Since inherent risk and control risk make up risk of material misstatement therefore another way to state audit risk model is. Detection risk is the risk that audit evidence Evidence in an Audit Evidence in an audit is information that is collected and required in the review of an entitys financial transactions balances and internal for any given audit assertion will fail to capture material misstatements. Audit risk refers to the possibility that the auditor may unknowingly fail to appropriately modify their opinion on financial statements that are materially misstated.

Detection risk forms the residual risk after taking into consideration the inherent and control risks pertaining to the audit engagement and the overall audit risk that the auditor is willing to accept. The auditor uses audit risk model to understand the relationship between detection risk and other risks in the audit risk model ie. Audit risk indicates that the auditor has not tested everything so there is still risk that a misstatement is.

The risk that the auditors audit procedures will fail to detect a misstatement and the risk that the misstatements will get through the audit procedures. This is due to without proper assessment of inherent and control risk auditors would have no basis for assessing the detection risk. This is particularly likely when there are several misstatements that are individually immaterial but which are material when aggregated.

Factors Affecting Detection Risk. Detection Risk alone could also make high audit risk. Audit risk Control risk x Detection risk x Inherent risk.

Proper understand will not only differentiate between different kinds of risks but also help you in recognizing the duties of management and auditor in a given context and the nature of their responsibilities. Detection risk is considered the last one of the three audit risk components. The audit risk model is used by the auditors to manage the overall risk of an audit engagement.

Audit Risks Inherent risks Control risks Detection risks. Distinguish among routine non-routineand estimation transactions. Audit Risk Inherent Risk Control Risk Detection Risk.

Detection risk is caused by the failure of the auditor to discover a material misstatement in the financial. Solutions for Chapter 5 Problem 1RQ. For a specified level of audit risk there is an inverse relationship between the assessed levels of inherent and control risks for an assertion and the level of risk that the auditor can accept that assertion.

Like audit risk detection risk does not assess detection risk rather it makes auditors seek to restrict it through the performance of substantive procedures Identify and describe the two components of the risk of material misstatement. Estimating the inherent risk IR f. Include an example of each.

Auditors proceed by examining the inherent and control risks of an audit engagement while gaining an understanding of the entity and its environment. Even though detection risk cannot be eliminated entirely the auditor. Principles of Auditing Other Assurance Services 21st Edition Edit edition.

The client company takes on audit risk because an independent third party is performing the audit. Thus the lower the assessments of inherent and control risks the. Describe the relationship between detection risk and audit risk.

On the other hand detection risk is the risk that is dependent entirely on the auditors. There are certain relationships among audit risk components. Detection risk is the risk that auditors fail to detect material misstatements that exist on the financial statements.

The outcome is that an auditor would conclude that there is no material. DETECTION RISK EVIDENCE ACCUMULATION 3 D THE AUDIT RISK MODEL IN PRACTICE 5 This is defined in AUS 402 as the susceptibility of an account balance to misstatement that could be material assuming there were no related internal controls AUS 40209. Which of the following statements best describes the role of audit risk in a financial statement audit.

Let me clarify the formula here. View Homework Help - Hw 5 from ACCT 402 at California State University Fullerton. Can the auditorsreduce inherent risk by performing audit procedures.

This enables the auditor to determine an acceptable level of detection risk. Describe the relationship between detection risk and audit risk. 5-1 Describe the relationship between detection risk and audit risk.

Describe the relationship betweendetection risk and audit risk. This is often represented in equation form as follows. Defi ne inherent risk.

These types of audit risk are dependent on the business transactions and internal control system that the client has in place. Identify and describe the two componentsof the risk of material misstatement. Just because the model use multiplies here it does not mean that the need to be multiple to get audit risk.

Auditing 1 Comment 1 minute of reading. Principles of Auditing and Other Assurance Services with ACL Software CD 18th Edition Edit edition Solutions for Chapter 5 Problem 1RQ. Describe the relationship between detection risk and audit risk.

Audit risk indicates that the auditor has tested all transactions. Audit Risk Risk of Material Misstatement Detection Risk.

How Is Audit Risk Impacted With Changes In The Assessment Of Inherent Risk Control Risk And Detection Risk Universal Cpa Review

Comments

Post a Comment